Want to learn how to better manage your money?

This list of personal finance books for beginners is the culmination of many years of obsessive reading of personal finance and investment books.

I’ve read all of the books below about finance for beginners.

They are from all over the world, including the United States, the United Kingdom, and Australia.

When you’re just starting out on your money management journey, the specifics aren’t important. Motivation and inspiration are what you need to take action. The books for finance beginners below have it in spades.

The Best Personal Finance Books for Beginners

All of the links below are to Amazon, but you could probably get these from your local library.

Quick tip: Some of the books below are available as audiobooks through Audible. You can get a free trial to Audible here.

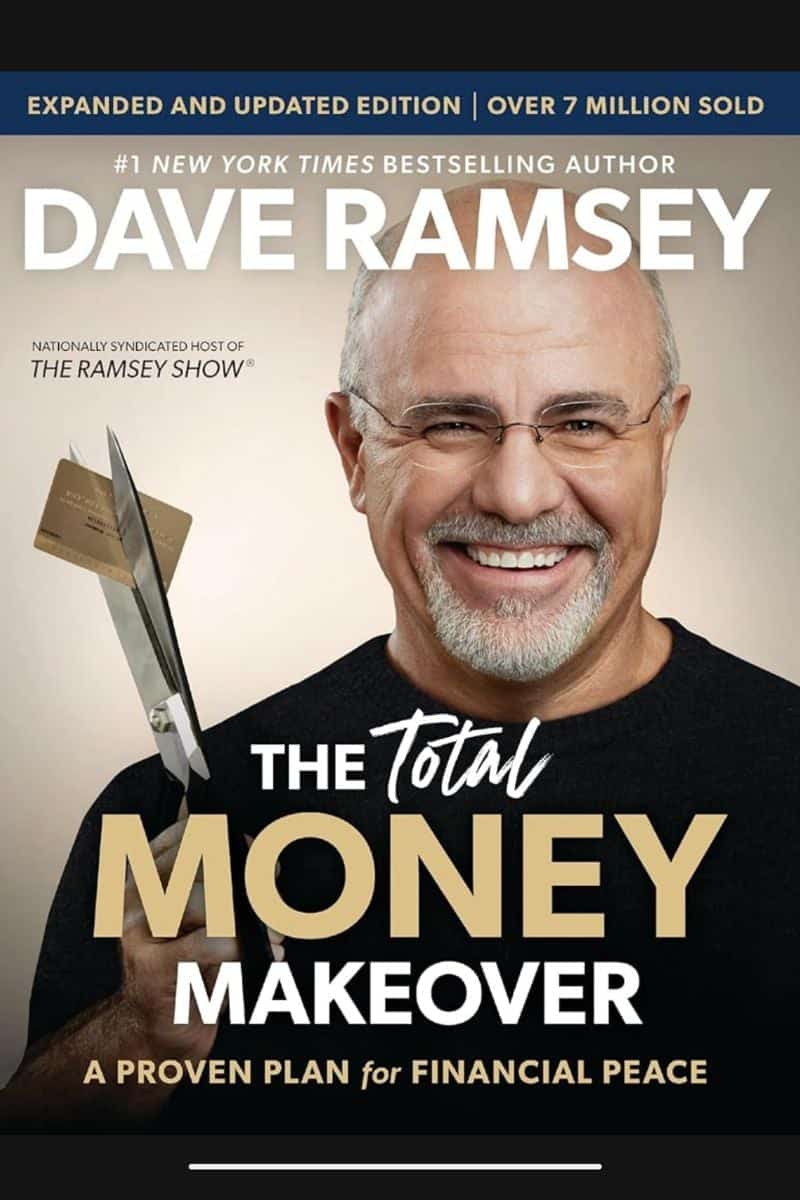

1. The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness

Dave Ramsey is a huge deal in the personal finance world.

His book, The Total Money Makeover, has been topping Amazon bestseller lists for years and shows no signs of slowing down.

His advice is to the point, and he can be a little blunt, but his system has helped millions of people get out of debt and start living life on their own terms.

Related post: 25 Dave Ramsey Tips That’ll Help You Slay Debt

2. The Simple Path to Wealth: Your roadmap to financial independence and a rich, free life

If you just read one finance book for beginners, let it be this one.

This book has taken the personal finance blogging world by storm, and I’m picking it to become one of the best personal finance books of all time due to the practical and enjoyable nature in which it is written.

JL Collins (of the blog of the same name) wrote this book, inspired by a series of letters to his daughter, who is rather more interested in other things in life than money, but knows she needs to look after her money.

So, like any good dad, he wrote one of the most thorough and useful finance books for beginners, to pass on his knowledge to his daughter.

The Simple Path to Wealth covers everything from avoiding debt, building an emergency fund right through to putting your money to work for you.

This is my pick for the best investment book for beginners.

3. Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence

Some say Your Money or Your Life is the original book on financial independence as it eschews consumerism and questions norms such as working costs (daily coffee, professional wardrobe, transport, etc) and their impact on your real earnings.

I’d recommend this for people who know they need to save and maybe have a budget in place but can’t cross the divide between living frugally and building wealth.

Your Money or Your Life requires some time to work through – yes, I said work.

There are some exercises involved which can completely change the way you view your money.

4. Smart Couples Finish Rich, Revised and Updated: 9 Steps to Creating a Rich Future for You and Your Partner

If you are your partner aren’t on the same page about money, this is the book you need.

I’ve long known that the only way to achieve our goals was with a solid team effort.

I wish I had this book when I pitched my crazy dream to my husband.

It’s practical, enjoyable and highly likely to change your life.

Check out Smart Couples Finish Rich here

Some of my personal favourites:

When I decided to get my finances sorted after being terrible with money, the first step was to educate myself in money management.

I would hang out in the finance aisles at bookshops and the local library, picking up books that appealed to me.

At the bottom of this post, I have a list of my personal favourites.

Some were over my head with technical details, and some were just plain boring.

In the beginning, the books that appealed to me the most were personal stories. I wanted to read about how other people had gotten out of debt, saved for a house deposit, purchased investment properties, or built wealth.

After that, I wanted to learn more about putting my money to work, and I sought out investing books for beginners to further that area of knowledge.

5. The Four Hour Workweek

I read The 4-Hour Work Week when I was 1 million weeks pregnant (in 2012) and facing a decision on whether I should quit my job to stay home with my baby or keep working and surrender half of my income to daycare whilst also never seeing my child.

It was a GAME-CHANGER.

Like a lot of bloggers, the 4HWW was the catalyst for a new career as a remote virtual assistant and now a full-time blogger.

I work way more than four hours a week, but I work on my own terms, and still believe in the main ethos of the book.

If you are thinking of pursuing financial independence via a digital career, definitely pick up a copy.

6. How I Lived for a Year on Just a Pound a Day

I picked this up purely out of curiosity.

Why on earth would anyone choose to live on just a pound a day?

Well, the author wanted to buy her brother a very expensive wedding gift.

She only worked part-time and didn’t want to change that, so she had to scrimp on her living costs.

Now I think back, it was a very simple concept, but at the time, I ate out for almost every meal and spent hundreds each week on non-essentials like handbags and vodka.

This book is an easy read and I recommend it for the complete beginner.

There are no big scary numbers in it.

It was this book that spurred me to question how different life could be if I just stopped spending.

7. From 0 to 130 Properties in 3.5 Years

I’ve always been interested in investment property, as an uncle of mine did very well with buying property before the mining boom in Perth, Western Australia and was always in my ear about buying property (thanks, Uncle Allan).

But getting my first cash deposit together seemed impossible, as I couldn’t save money because I spent it all (funny how that works!).

From 0-130 Properies in 3.5 Years was a really interesting read about how Steve McKnight built a property portfolio from scratch using a variety of different methods and creative financing.

I really liked the simple breakdown.

I’d recommend From 0-130 properties for anybody interested in property investment as a vehicle for building wealth. It’s Australia-centric but the basic concepts are applicable anywhere.

8. The One-Page Financial Plan: A Simple Way To Be Smart About Your Money

As far as financial planning books for beginners go, the one-page financial plan is a must-read.

It’s simple, actionable and written by a financial advisor.

Full disclosure – I was given a copy of this book to review last year.

And I still loved it because it was easy to understand and, more importantly, implement.

The premise is simple: get all your financial goals on a one-page plan.

No screeds of spreadsheets and printouts. Anyone can write a one-page financial plan.

It’s written by Carl Richards of The Behaviour Gap and illustrated with simple hand-drawn charts.

The author is a certified financial planner, so his advice is backed by credentials without being jargon-y.

I’d recommend The One-Page Financial Plan for people who want to create a big-picture plan for their finances.

9. Your Mortgage and How to Pay it Off in 5 Years

This is another frugality book, which was exactly what I needed when I read it.

It details how the author and her husband paid off their home in three years with an income under $50/k per year.

It covers the core concepts of money management for beginners, but its strength lies in the mortgage information specifically targeted towards first-home buyers.

This includes getting your deposit together, finding the right house and how much you should spend.

Note that the examples are outdated when it comes to current house prices, but the core principles of budgeting and making sacrifices to pay off your mortgage faster still apply.

I’d recommend it for people wanting to buy their first home.

What is your favourite money book? Have you read any of my favourites?