If you’re into saving money (and who isn’t?) then you need to know all about cashback sites. These cashback websites can save you some serious cash when shopping online, or even paying bills.

So you can earn money by doing exactly what you normally would anyway.

Whatever you tend to purchase from an online retailer – whether it’s clothes, household goods, toys, car insurance, or even a new mobile phone contract – there is almost always a way of earning cashback when you buy.

Here at Mum’s Money, we’re fully aware of the fact that this may well sound too good to be true – but sites like Quidco and Topcashback exist to help companies get ahead of their competitors.

Contents

If a customer can get cashback from online shops every time they buy, then they’re more likely to start shopping there – as well as to return to the same store at a later date.

Whether you’ve never used a cashback site before, want to find the highest paying cashback site, or are looking around for more UK cashback sites you could sign up with, this guide will walk you through all you should know about this clever way to save money.

Put it this way. If a cashback provider offers payout bonuses when you shop with your favourite retailers, why on earth wouldn’t you be using cashback sites to make a few bonus pounds?

From topping up your child’s savings account to treating yourself to something lovely, extra money is surely always most welcome.

This article will outline:

- What cashback sites are and how they work;

- How you can get money back every time you shop;

- What cashback deals entail and how to make the most of them;

- Plus a comparison of the 10 best cashback sites in the UK marketplace today.

By the end of this piece, you’ll know all about how to use cashback sites to your advantage, so you’re ready to sign up and snap up some incredible deals!

What you need to know about cashback sites

To begin, this section will outline what cashback sites are, how they work, and how you can expect to be paid – as well as how much.

We’ll also look at which online shopping options offer payments via these sites.

What are cashback sites?

Cashback sites are websites containing lists of all the retailers they partner with – and the cashback rates for each.

Once you’ve found the store you want, you click a link to shop there instead of accessing the site directly.

You can earn cashback when you shop online because the retailer pays cashback websites a commission for sending customers their way.

Some of that bounty is then passed onto you, typically as a percentage of the sale value.

It’s a win for all parties. You, me, and the cashback sites get a cut of the profits, while the retailer benefits by getting consumers to shop with them rather than elsewhere – such as with their biggest competitors.

How do cashback sites work?

A cashback website is very simple to use. Instead of going straight to the store, you visit the site first so you can earn cashback.

Once you’ve clicked the link to the retailer, you can simply shop as usual.

Accessing the retailer from one of the top cashback sites rather than directly is the only difference. Once you make a purchase, the online store will pay a commission to whichever cashback site you’ve used.

The cashback site concerned will then pay you a percentage of this commission or a fixed fee. This free money is to say thanks to you for earning the cashback site a commission.

In turn, this is paid to them by the retailer in return for sending them a paying customer.

How much do cashback sites pay?

Cashback rates vary from one provider to another. Sometimes you’ll be paid a percentage of the sale value, or you may be offered a fixed sum for signing up to or buying something.

With broadband, car insurance, or a mobile phone, for instance, you could earn a fixed amount for taking out an annual policy or contract with certain companies.

In some cases, this could be just a few quid – or it could be close to £100. In general, the more you spend, the higher the reward.

Where a percentage of the sale value is offered, you’re looking at anywhere between 1% and 2% right up to a generous 25% for some qualifying purchases made at selected retailers.

How is cashback paid to me?

Cashback is generally paid to your PayPal account or by direct bank transfer to your nominated bank account.

Until you cash out, you can see how much cashback you’ve earned by logging into your account on the cashback site.

The majority of cashback websites do have a minimum threshold which must be reached before you can withdraw money from your cashback site account.

If you prefer to earn a gift card, this option is also offered by a number of cashback sites.

Which online stores offer cashback?

As a general rule of thumb: if you can shop online there, the chances are that the retailer will have partnered with one or more cashback websites.

If you tend to do most of your online shopping at the same favourite stores, then it’s worth checking if other cashback sites might offer a higher amount of free cashback before signing up – and certainly before making any big purchase.

In addition to your annual cashback earnings, you may also be able to take advantage of exclusive deals or one-off cashback offers by checking each cashback site carefully.

Top 10 UK cashback sites comparison

If you want to start earning cashback every time you shop online, then these are the top 10 cashback sites for giving you money back on your purchases.

1. TopCashback

This is one of the UK’s best cashback sites. It’s quick and simple to sign up and TopCashback says the average member earns around £345 per year from taking advantage of their cashback deals.

TopCashback will pay into bank accounts or PayPal, or you can opt for gift cards instead. The site claims that just about every purchase you make will be eligible for cashback.

Their partners include fashion retailers, homeware stores, mobile phone providers, insurance companies, broadband suppliers, and more.

The option of premium membership is offered for £5 per year, and this would be deducted from the cashback you make. It’s free to join if you go for a classic account.

Once you earn money, this should show on your Earnings page within a week. You will need to wait for the retailer’s return period to pass before the cashback becomes payable, however.

TopCashback can pay your free cashback into a bank account or PayPal, or you can claim it as gift vouchers to spend at Amazon, Google Play, Just Eat, and dozens more.

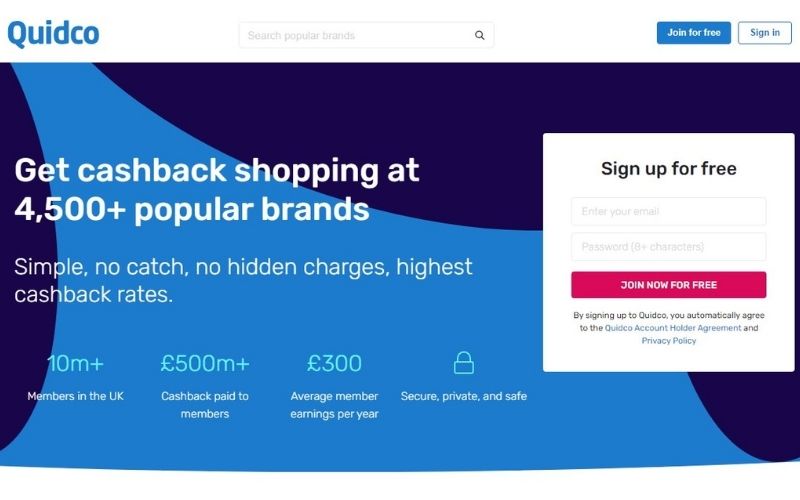

2. Quidco

Quidco is another of the most popular picks in the UK market with those using cashback sites.

Quidco is another of the most popular picks in the UK market with those using cashback sites.

Their homepage is pretty impressive, saying they have over 10 million UK members who have been paid a total in excess of £500 million.

TopCashback and Quidco are bigger than other UK cashback sites and are thus big rivals. There are pros and cons to using each.

Quidco claims the average member earns £300 per year through them, so around £45 less than with TopCashback.

Their premium membership option costs £1 per month, so £12 per year as compared to £5 with TopCashback.

One of the biggest pluses of using Quidco, though, is their ‘highest cashback guarantee’ which they say means their members earn more per purchase.

In fact, if you find a higher qualifying rate of cashback, they promise to match that and pay a small additional bonus too.

Typical Quidco cashback rates include 5% with Argos (a good way to save since Argos doesn’t price match), 10% with M&S, and up to £100 with Currys.

There’s a helpful quick reference list of partners at the bottom of the homepage, so you can see at a glance the store you want is included.

2. KidStart

KidStart works a little differently from Quidco and TopCashback.

The idea is to top up your child’s savings account each time you shop, thus helping to buy things they need or building a nest egg to use in later life.

They work with over 2,300 retailers and you can withdraw funds to a child’s bank account once you’ve earned £10 or more.

The list of partners includes John Lewis & Partners and the Apple online store, which are not always found on cashback sites.

Whether you want to buy groceries and household items from Waitrose and John Lewis, clothing and footwear from Boden and Clarks or need to pay for utilities, holidays, or entertainment, KidStart has a partner that you can shop with.

It’s a great way of making saving for your child’s future accessible to all as well as affordable, and according to KidStart, you can save around £250 per year when shopping online through them.

The downside is that KidStart doesn’t always offer rates that are as competitive as those offered by the likes of TopCashback and Quidco.

Sometimes you can earn almost three times as much with them as you would with KidStart, so do check carefully.

4. Widilo

Widilo is a relative newcomer to the UK cashback market, but may sometimes offer the best deal out there.

As usual, you click the links on the site when you want to shop with one of their retail partners, and they work with big names like Asos, Hotels.com and Not On The High Street and many more.

At the time of writing, shoppers could earn up to 13% cashback with Vivino, for example.

The site also offers discount codes so you can save money at the point of sale.

5. OhMyDosh

OhMyDosh claims to be the fastest paying of the UK’s cashback sites and boasts close to a million members.

As with Swagbucks, you can also undertake tasks such as completing surveys or participating in free trials to earn more money.

It’s free to join OhMyDosh and you don’t need to give your bank or PayPal details until you want to cash out.

The payment threshold is £10, and this site aims to pay members within 3 to 5 days of doing this.

6. Swagbucks

Swagbucks is more than just a cashback site.

It is also known for offering paid surveys and as a money making app where users are rewarded for completing other tasks – such as downloading apps or watching short videos.

Swagbucks can also be used as a source of cashback when you shop online.

Your purchases can earn you Swagbucks when using their links, and these can then be traded for cash paid via PayPal or a range of gift cards.

7. Airtime Rewards

Airtime Rewards allows you to earn cashback that will be used to give money off your mobile phone bill.

Like other sites, it’s free to join and you’re rewarded while you shop, but instead of being paid by bank transfer, you’ll get a lower mobile phone bill each month.

The app can be downloaded via Apple or Google Play, and lots of major retailers offer cashback to Airtime Rewards members.

8. Complete Savings

Complete Savings offers higher levels of cashback than other sites – but there is a caveat.

While it’s initially free to join, there is a £15 monthly fee after the trial period ends.

The reward is at least 10% cashback guaranteed, and Complete Savings also offers monthly bonuses.

You can also buy gift cards via the site, with discounts of up to 20% up for grabs.

9. Honey

Honey isn’t a cashback site, strictly speaking – but it does allow you to grab the best discounts available on any given day.

It’s actually a browser extension that tracks down and applies the top discount and voucher codes when you shop.

Once you’ve added the extension it works automatically, and it’s a super simple and reliable way of nabbing the best available deals when ordering items or services online.

10. Rakuten

Rakuten also offers a browser extension – and a whole lot more besides. Users can earn rewards when buying everything from groceries to holidays, and can also access special member discounts too.

It’s a simple reward structure, where 1 point equals 1 penny and 100 points are worth £1. Points can then be exchanged for gift cards, experiences, or other good stuff.

These can be earned either via Rakuten stores or through their big brand partners.

Cashback sites in the UK: Top tips

Shop around for the best deal first

If you’re planning to use cashback sites to save money, don’t lose sight of the fact that finding the retail site offering the best deal should be your focus.

If the online shops partnered with cashback sites are more expensive for a particular item, then you could miss out.

Don’t forget to use comparison sites as you usually would when shopping around.

A quick search with one of those could potentially save you far more money than using cashback sites alone.

Remember also – the more you intend to spend, the more this rule can apply!

Cashback is not guaranteed

Though cashback websites pledge to pay you when shopping online via their links, problems can and do arise.

Sometimes these are technical issues to do with the incorrect use of tracking links, so do check carefully before you shop.

Especially when investing in big ticket items, or signing up for something longer term like a mobile phone bill.

The retailers or service providers may also dispute the cashback, querying either the amount or the fact that the purchase actually qualifies.

When they don’t pay the commission to the cashback site, then nor will the customer – you – receive their cut.

It’s wise, therefore, to think of cashback as a welcome bonus rather than a guaranteed source of income.

Withdraw your cashback asap

Always withdraw your cashback rewards as soon as you possibly can. Normally you’ll need to hit a set threshold before you’re permitted to do this.

If you leave cashback in an account on the site, then be prepared for the eventuality of it never reaching your PayPal or bank account. If the cashback site collapses, you’ll lose out.

Once you receive cashback into your bank account you may also be able to accrue interest on the amount. It all adds up!

If you’re making a big purchase when it’s a good idea to clear the cookies from your smartphone, tablet or computer before going ahead.

Where other cookies exist, they may make it appear that the referral came from a source other than the cashback site you used.

This could mean the referral fee is lost in the ether rather than you getting money back on the purchase.

In many cases, the last cookie will be the one that counts, so do make sure you go direct from the cashback site to the retailer you want to buy from.

Without stopping anywhere else in-between, such as to compare prices. (It’s best to take that step in advance of clicking the link.)

Consider a cashback credit card

As long as you can pay off the balance in full every month, cashback credit cards mean you can earn even more rewards each time you shop.

A cashback debit or credit card is an entirely separate entity and is not tied to any cashback site. With some paying up to 5% on all purchases, they’re another option well worth looking into.

Cashback sites in the UK: Frequently asked questions

Where can I get cashback in the UK?

There are a few ways of getting cashback in the UK, including signing up to cashback sites and using a cashback credit card. These two can also be combined so you can make extra money.

Cashback sites make you money when you click their links to buy something, and when using them you’ll get cashback at a later date in the form of cash or a gift voucher code.

Which cashback site is best in the UK?

Opinions vary as to which is the best cashback site in the UK, but TopCashback and Quidco are the biggest and most well-known operators.

The best cashback site in the UK is really the one offering the top deal at the time of shopping, as rates chop and change between cashback sites and their partners.

Sometimes you may also be offered a limited-time deal that will bag you a higher reward.

What is the best cashback website?

The best cashback website to use depend on what you’re buying, where you’re shopping, and where you live.

In Australia, for example, Mum’s Money recommends Cashrewards, but they don’t operate in the UK.

Here, Quidco and TopCashback tend to be the best cashback sites overall – but this can vary with each purchase.

Which cashback app is best?

If you want to install just one app on your device, then the pick of the cashback apps is a toss-up between TopCashback and Quidco.

The former’s premium membership costs less and members tend to earn more, while with the latter users can take advantage of the Quidco’s highest cashback guarantee.

Is TopCashback UK legit?

TopCashback is indeed legit – as are the other cashback sites covered in this guide. Consumers have been using cashback sites in the UK for many years now – mostly with great success.

When shopping just make sure you prioritise finding the best deal, read the instructions carefully, think of cashback as a bonus rather than 100% guaranteed, and always withdraw your rewards as soon as you can.

Is Quidco better than TopCashback?

Ask anyone who uses cashback sites and they will probably prefer Quidco to TopCashback – or vice versa.

The recommended approach is to compare the cashback rate offered by each site every time you shop to make sure get as much money back as possible.

While TopCashback members tend to earn more, Quidco’s are covered by their highest cashback guarantee.

Summary | Are cashback sites worth it?

It’s free to join a cashback site or to download cashback apps, so what have you got to lose?

A cashback account lets you earn money for doing exactly what you were going to do anyway.

All it takes is a few minutes to sign up, plus a matter of seconds each time to visit the app or cashback site each time you want to buy something.

If you can spare that tiny amount of time, it’s a complete no-brainer!

To get the most out of it, Mum’s Money recommends signing up with a few of our favourite cashback brands.

Every time you want to buy an item or sign up for a service, you can then check the cashback market for the best deal.

Many users of cashback sites make hundreds of pounds per year simply by using the links when shopping.

For some, this free membership rewards them with thousands. It all depends on your spending habits.

There’s only one way to find out what cashback sites can do for you, and that’s to sign up with one or more.

As it’s free to join, all you have to lose is a few minutes of your time – and you could gain hundreds of pounds per year for doing very little!

Related:

- 32 Free Baby Samples and Offers in the UK

- 13 Best Product Testing Websites in the UK

- Do Nectar Points Expire? We Find Out.

- Does IKEA Offer an NHS Discount? [Answered]