You’ve quit your daily coffee, live in constant fear of your debit card being declined, take public transport to work and your idea of an evening out is following the store assistant with the sticker gun around the supermarket to bag the marked down items before anyone else.

Things are tight, and you can’t see a way to cut your spending any further.

Oh man, have I been there. But, there is hope.

See, you’re reading this article which means you have access to the internet, which I like to think of as the most powerful money-saving tool ever created.

Figuring out how to save money when you’re broke takes a bit of creative thinking and a lot of sacrifices, but it’s completely possible to do.

Note: A quick word on making extra money. Sometimes you can do everything within your power to save money, and you still need more. Check out these ways to make extra money online.

Now, on to the money-saving tips.

If you’re working on a tight budget you absolutely need to plan your spending.

When you’re in survival mode, you just need to focus on keeping your head above water until your finances improve.

I recommend writing out a bare-bones budget (read how to create a survival budget here) and giving yourself the grace to let go of financial goals for the short-term.

Once you’ve done that, these are my top tips for saving money on your essential expenses:

Food

If you are anything like me, your biggest expense is food.

Luckily, it’s also the best category to save money. These are my top ways to save on groceries when money is tight.

Write a recurring meal plan

What is a recurring meal plan you ask? It’s a meal plan which repeats itself often. I find either 7 days or 5 days to be the best frequency.

If you like a lot of variety in your meals you might struggle but a recurring meal plan is smart for lots of reasons. You can bulk buy ingredients which is a lot cheaper.

Then you can freezer cook or batch cook so you only cook once for multiple meals, saving time and electricity costs.

I am not a nutritionist, but I’ve found that my body reacts well to eating similar meals regularly, which helps reduce doctor’s visits and medical expenses.

What does a recurring meal plan look like?

For me, it’s overnight oats for breakfast every single day.

Lunch is scrambled or fried eggs and sautéed veggies, plus a piece of grainy toast smothered in real butter if I’m especially hungry.

Dinner (depending on the season) could be chilli with brown rice, rice and beans, spaghetti, veggie curry with brown rice, stir-fry chicken and veggies, slow-cooker stew, steak and salad.

Check out these ideas for hearty winter meals on a budget.

As you can see above, I can purchase bulk brown rice, beans and cheap cuts of meat for stir-fries and stews.

I grow lettuce for salads in my garden and will happily buy cheaper overripe bags of vegetables from my local grocer to throw into the stew, curry or stir fry.

The idea is that no item in your shopping basket should be for just one meal, everything you buy when you use a recurring meal plan should be for at least 2 meals, preferably more.

Cut out 50% of your meat consumption

Meat is easily the single highest item in my shopping basket.

The high cost and environmental factors (have you seen Cowspiracy?) mean I try to eat as little meat as possible.

I’ve been able to hugely reduce the amount of ground beef I need to use in my meals by halving the usual amount of meat and replacing with red lentils.

Red lentils are like nature’s wonder food. They absorb everything, and my kids can’t tell they are there so I don’t have to hide them.

Little savings add up

If an expense is an absolute necessity, figure out a way to get it for free or at a discount.

Neighbourhood Facebook groups and online forums are great places to inquire about borrowing or bartering items, including food.

You could also join up with neighbours and friends to make bulk purchases.

Freecycle is an excellent resource for getting free items that people no longer need.

If you can’t borrow or buy used, I’m not saying you have to become an extreme couponer, but saving a buck or two on every purchase will add up and give your tight budget some breathing room.

Websites like CouponSherpa.com are worth checking out before you make a purchase to find coupons and see where savings can be made before you enter the store.

One of my favourite ways to make extra savings is to get cash back on my purchases with Ebates.

Click here to join Ebates and get $10 towards your first $25 qualifying purchase.

Have the right tools for the job

Invest in a crock pot/slow cooker. You can often find them second-hand at thrift stores or get a basic one on Amazon if your budget allows it.

Other money-saving tools include quality reusable containers for taking lunches to work and storing frozen meals. If you’re freezer cooking, quality Ziploc bags to keep all the parts of the meal separated.

A friend of mine swears by her air fryer. She invested in the best air fryer her budget would allow, and it has solved her kid’s picky food issues.

She no longer needs to buy takeaway foods so for a small upfront cost she will save thousands over her lifetime.

Housing

The need for appropriate shelter is, of course, non-negotiable. But, do you need as much house as you have?

We saved over $600 per month by downsizing to a small home with our kids and now we’ve made the move to a smaller home we wouldn’t change it for the world.

If you own a large house that would command a high rent, could you move out for a while and rent a smaller place?

Could you take in a roommate to help pay your expenses?

What about becoming an Airbnb host? That way you can pick and choose which days you are able to host guests and work around your existing schedule.

At my very lowest financial point, I seriously considered moving in with my parents until our financial situation improved.

It wouldn’t have been fun, but it definitely would have given us time to get our finances in order and recover our savings account.

Utilities

Electricity

There are many ways to cut down on your electricity bill if you’re willing to get creative. In my experience, the largest expense has always been heating our home in the winter.

We have an older home which means lots of draughts and single pane windows causing massive heat loss.

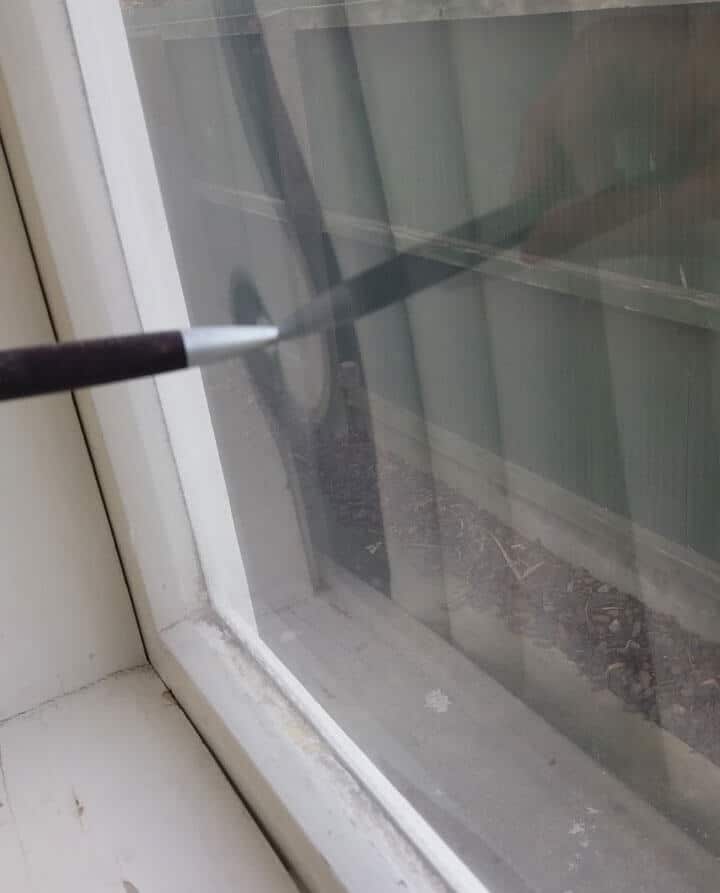

There are several ways to reduce heat loss frugally, my favourite is using window film to add a double glazing effect to windows.

I use Duck Window Film (pictured below) in my house but I’ve also heard good things about the 3M product.

We don’t own an electric dryer, preferring to use the rotary clothesline in our backyard.

I also prefer to run a cold wash, it’s shown to be less damaging to clothes and even with two dirt-loving boys, a cold wash gets the job done.

Before we had kids we would refuse to turn on the heating unless it was truly freezing.

A woolly jumper and a cup of tea or homemade veggie soup do amazing things for one’s body temperature, although now I’m a mother I wouldn’t risk my kids getting sick, so we use the heating when necessary.

Depending on how tight things are, these extreme budgeting tips might be worth considering:

- Move every family member into the same bedroom. Preferably the largest one. Now you only have to heat one bedroom at night. Make sure you crack a window open during the day to allow fresh air to circulate.

- Cut your internet connection at home and use public WIFI when you have access.

- If you have kids, visiting the library each day after school serves three frugal purposes. Firstly, it gives them a quiet place to do their homework. Secondly, it’s heated for you. Finally, most libraries offer free internet access so you can keep up to date with life if you have got rid of your home internet connection to save money.

Transport

Depending on your life and work situation, it can be hard to cut down your transport bill. That said, we’ve cut ours in 3 ways and I’ll list some others below.

Becoming a one-car family

Could you possibly sell or just stop driving the second vehicle? We have one used car that cost $1000. It’s from 1992. It’s ugly but cheap to run and gets us from A to B.

Cycle commute

This was a huge money saver for us.

My husband began cycling to work a year ago and has not missed a day since.

He loves it as he can skip traffic issues, get more exercise and have time to decompress after work (on his ride home).

I love it because it saves us an enormous amount of money and I have the car if I need to take the kids anywhere.

Walk more

Could you walk to the places you need to go daily? We are lucky enough to live within a 20-minute walking distance to 2 supermarkets, my son’s preschool and our local village shops.

If things got really tight, we could just sell our only car and become car-free.

Carpool with colleagues

Do you work with someone who lives nearby? Suggest carpooling to save money and reduce the number of vehicles on the road.

If you’re prepared to challenge the norm (and who wants to be normal anyway??) there are ways to squeeze extra savings from an already tight budget.

With a bit of creative thinking and manual input, you can save more and become fitter and healthier in the process. It’s a win-win!

Like this? Pin it for later!

Related: What Is the 100 Envelope Challenge? Is It Right for You?