It’s been a long while since I’ve written anything personal on this website BUT, we hit such a major milestone recently that I just had to share it.

On Friday, 31 December 2021 at 10.22am my husband handed in his letter of resignation.

We have finally achieved our early semi retirement goal.

This means we have enough to semi retire right now and will still reach full early retirement within the next ten years.

How we semi-retired early

This plan has been such a long time in the making. First we nailed consumer debt, then we saved enough to travel around the world with our young kids.

We were gone for 15 months and it was the impetus for changing our lifestyle to pursue our own version of financial independence.

After we figured out we’d really like to just travel forever, the goal became about creating a location independent income.

At the same time, we lived as frugally as possible in a teeny tiny house that most people probably wouldn’t live in, driving an old Toyota Corolla which still has many good years in her.

We saved/invested every dollar of my income while paying for our living costs solely on my husband’s wage.

(Here are my original blog posts written in 2015 and 2016 if you’re interested in the beginning of the plan: How I’m Creating a Life I Don’t Need to Retire From and How to Semi-Retire in Your 30s)

Our Actual FIRE Numbers

Yes – I’m sharing our actual numbers. I’ve battled with this but real numbers were so helpful to me as examples of how other people do things. I hope I don’t regret this decision.

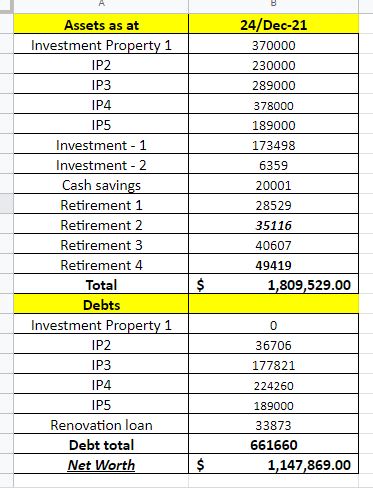

Below is a screenshot of our net worth as of Christmas Eve 2021.

(The values of all the properties are conservative estimates, considering the insane property boom we’ve just experienced.)

Our FIRE number is 1 million in investments and a paid off house.

We can and do live an excellent life for $40,000 per year. This is primarily because we do not have a housing cost to contend with.

We live in Investment Property 1 on the above chart.

We still consider it an investment property as it was purchased with the intent on being a rental property (we actually had the purchasing documents witnessed by a notary public in Mexico on our travels).

The property was rented to tenants for many years before we moved into it, and we plan to rent it while we travel, so I include it in our net worth.

As a paid off property, the rental income it generates will provide an income stream which should cover rent we have to pay in the places we travel to. The property should rent for around $400/week or $1730/month.

That said, it is not part of our FIRE number.

Our current FIRE balance is $1,147,869 (Net worth) – $370,000 (Property) = $777,869

Including property equity in FIRE numbers?

It’s true you can’t spend your equity unless you borrow against it or sell your property.

We might eventually sell 2 or 3 properties and put the proceeds into index funds, or pay down all the property debt and live off the rents.

Is living off rental income actually viable?

Our 4 properties currently rent for $1255/week combined. Add in the property we currently reside in and the combined weekly rental income comes to $1655/week or $86,060 annually.

Costs including mortgages, rates, insurance, maintenance and professional property management runs at around $60,000 annually with the mortgages making up $36,000 of that number.

If we were to pay down all of our properties and rent all five out – we would have an income of $86,060 – $24,000 – $62,060.

This number would be $47,060 if we were to reside in IP1 again (as we wouldn’t be paying for professional property management and tend to do our own maintenance on properties we live in).

This is considerably more than the 4% rule would allow us to draw from a million dollar portfolio in index funds BUT it comes with more risk (due to a lack of diversification).

Ideally, we would draw half of our income from free and clear rental properties and half from a portfolio of index funds.

But there is no rush to make this distinction yet as we aren’t actually retiring completely. No doubt the plan will endure many more iterations before we hit the drawdown period of our life.

Our living costs for the next two years will be funded solely from the online business which provides a full time income.

If we were planning to FIRE tomorrow, we’d sell some properties right now to tip the scales back towards shares.

However, we’ve always bought cash flow positive properties with at least a 7% gross yield.

This means they more than pay for themselves so hanging on to them does not affect our plans at all.

We are mindful that we have passed the peak of the cycle here in New Zealand. The tides are turning with interest rates and inflation rising rapidly. With this, credit is getting much harder to access and house prices are starting to slow.

No big deal though – we don’t need the money so we’ll keep our properties as a hedge against inflation and use the rents coming in each month to pay down the debts as quick as possible.

(I also feel a deep sense of responsibility as a property owner providing affordable rental homes for my tenants. The housing crisis is ugly and it’s impact means selling is more than just weighing up taxes, profits and allocations.)

Risks of this plan

Our biggest risks right now are interest rate rises and tax changes.

Tax changes in New Zealand mean that the interest portion of a rental property mortgage will not be deductible in the future (phased in over 4 years).

This is a ridiculous piece of legislation and is completely out of step with tax law in which businesses pay tax based on profit, not revenue.

But, it is for this reason that we plan to pay down our mortgages as fast as possible. The risk of interest rate rises will also be mitigated by this plan.

Long term travel plans

Our plan from April of 2022 is to travel with our kids. Primarily in Europe. We’ll be starting in Ireland and hopefully end up in Spain for a long period of time.

We have a rough plan to travel for two years. With the world the way it is right now, we still don’t really know what is going to happen but it’s good to have a tentative plan.

Will you still be investing in Semi Retirement?

Yes – but not aggressively.

We aim to invest all surplus rental income and around 10% of our “wage” into a 50/50 split between index funds and paying down investment property debt.

If we find that we actually need the money to enjoy our travels, we’ll stop putting money away. No big deal.

That really is it. It’s amazing how simple managing money becomes when you get clear of consumer debt and have enough assets that generate income for your future retirement.

Then it’s simply about ensuring you have enough to pay your living expenses on a day to day basis.

So you’re not actually retiring?

Nope, not me anyway – that’s why it’s called semi-retirement. My husband has left his physically exhausting job and is now the man of the house doing all the cooking and kid stuff which gives me more time to work on my business.

Which is honestly the best thing ever because I love what I do (plus I despise cooking).

Just knowing that we can live our life on our terms from here on out is incredible.

Being able to earn income wherever we go is what I’ve always dreamed of. As I wrote over on my Spain travel blog:

I like working. I like the structure and having objectives to achieve. Before I had my son I worked up to three jobs at a time. Not just because I like money… There is something to be said for a life combining fulfilling work with the freedom to change your surroundings whenever you choose.

Semi-retirement really is the best of both worlds.

If you’re chasing FIRE, just remember there are no hard rules, and if the RE bit isn’t your cup of tea, you can ignore that part and just enjoy financial independence and the security it brings.

It’s like a big warm money blanket cuddling you to sleep each night.

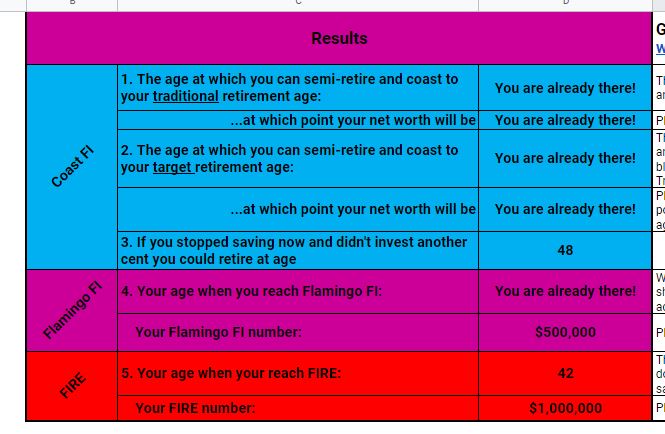

Resources that deserve a mention – Big thanks Tina from Money Flamingo for her awesome concept and calculator.

It really brought home for me that we could indeed frontload our investments and then coast our way to financial independence.

This strategy on turning equity into income from Strong Money Australia has helped me figure out a strategy to turn property equity into FIRE planning.

Have you considered semi-retirement as an alternative to early retirement?

Hi Emma. I am interested to know where your rental properties are with values that low and how recently you purchased them. Also how many children and what ages to live off that amount yearly?

HI Mandy, all our properties are in the South Island of New Zealand. 3 in Christchurch, 2 in other small towns. Purchased between 2006 and 2020. I really have undervalued them to be honest.

These are the purchase prices and dates:

IP1 – 195,000 in 2012

IP2 – 128,000 in 2006

IP3 – 190,000 in 2019 (wrote about that purchase here)

IP4 – 235,000 in 2019

IP5 – 189,000 in 2020

We have 2 boys under 10.

Hi Emma, I just saw this! Congratulations, that’s an amazing achievement! 🙂 I’m looking forward to hearing about your family travels, how exciting. And thanks for the shoutout, glad to hear you found the calculator helpful. All the best!

Thanks Tina – your blog has been so helpful 🙂

Hi Emma

Congratulations on your semi-retirement! I love reading your comments in the Kiwi Mustachian group, you have such great advice.

We are planning to FIRE at some point, as technically we have reached our number. I already quit the rat race to work as a freelancer / blogger / homesteader. But my husband still has projects he’d like to finish at his work, and then possibly ease into FIRE by going part time first.

Looking forward to reading more about your travels.

Pippa

Thank you Pippa, so kind of you to say. Sounds like you have the perfect balance there. Having the ability to choose when to call time is an amazing feeling.

How can I get updates to this? It’s great 🙂

Hi Ben, you can subscribe using the form in the sidebar of the website. I’m a bit slack at email but am trying very hard to send one a week. Thanks.