How do you know if you’re living beyond your means?

It might go something like this: You have a job.

Pay rent.

Have a car.

You didn’t have the cash for the car so you got a car loan.

Each week or month you commit a large chunk of money to maintain a depreciating asset.

You go shopping, eat out whenever you like, live your life.

You put your vacation on a credit card.

Eventually, you have no credit available, the credit card is maxed and you start to panic.

You are up sh*t creek. There is no paddle.

This is living beyond your means. I’ve been there.

If you are like me the panic is accompanied by the painful awareness that you have no idea how to change your situation. You consult Dr Google.

You will start to read everything you can about money management (start with this book, ‘‘The Simple Path to Wealth: it’s the one I wish I’d read ten years ago).

You will be terrified.

There will be a period of intense disappointment when you realise how different things could have been.

You cannot change the past, so you resolve to alter the future.

You find a strong stick and drag your way out of that quagmire of a creek, eyes cast towards your feet in shame.

I know this story well because it is mine.

Like many people who blog about money, I hit bottom before I learned how to manage finances.

And yet, my husband and I have recently celebrated one year of travel.

From New Zealand to the USA to Mexico and Europe. A Mediterranean cruise. Disney World. All paid for with savings. No debt at all.

It’s been epic.

And once upon a time, I was just like you, spending more than I earned and stressing about money.

Let me tell you how I turned my finances around.

How I Started to Live Within My Means

Living within your means is achievable for everyone.

For me, I had to ignore my income and focus on my expenses.

I drew up a budget that accounted for everything we needed, regardless of how much we earned.

I was aware of our income limitations, of course, but they did not dictate how I budgeted.

The figure changed slightly to account for increases in expenses as I went from living in a shared house with roommates to living in a one-bedroom apartment and then to living in my own house with my family.

You see, the problem with budgeting the other way round – by working out what you earn and then how to divvy it up to cover what you need/want – means you’ll never have a spare dollar.

I promise you every gap will be filled.

If you are a master budgeter you might plan savings as part of your budget but the reality is that most people don’t pay themselves first.

They pay the bills and then what’s left has to cover everything else.

There might be a little left over for savings, but more than likely, that little bit will go on crap you don’t need.

Our first year as parents was a financial shock to the system.

We were used to earning two full-time incomes, which allowed us to save over 50% of our combined income.

The system of budgeting I describe below is the only thing that kept us afloat (and has done ever since).

Side note: I believe living on one income and saving the other is the number one way for couples to save – especially in the years leading up to starting a family.

Years of living on one income and pretending like the other didn’t exist is the whole reason I was able to ignore my means when drawing up my first family budget.

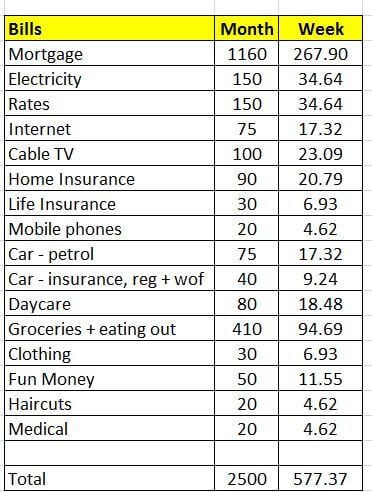

A Look At My Fixed Living Costs (FLC)

And also a massive disclaimer because I’ve been getting some snarky comments and emails implying that I suggest you should mimic my expenses – OF COURSE NOT, that is ridiculous.

I am only sharing my budget to illustrate how we put this system in place.

I’m not talking about just surviving here.

This site is called Money Can Buy Me Happiness – not Having No Money Makes Me Hate My Life.

Your FLC should include everything you need to stay alive and ahead of your creditors and a small allowance you can blow however you want.

For example, the budget I drew up gave us a little fun money ($25 each per month) and covered all the significant expenses (mortgage, insurance, groceries, electricity etc).

The most recent amount – pre-travel – that I could whittle my FLC down to was $2500 per month or $30,000 per year.

That included mortgage payments, insurance, taxes, rates, electricity, internet, cable TV, groceries, daycare, all car-related expenses, clothes, medical, and fun money. Everything.

On the first of every month, $2500 was transferred from the mortgage offset account into the ‘Bills’ account, and we lived as if $2500 was all we had.

Every wage or salary payment was made directly to our mortgage offset account.

Depending on where you live, $2500 may or may not be a lot of money. Where I live, it’s not a lot of money.

Our house expenses accounted for just over half of that and we were very careful with the remainder.

Our home is in a city with many wonderful parks and woodlands to explore for free so we made the most of low-cost activities.

I also bought a cheap home espresso machine so I could make proper coffee at home.

That single act saved us thousands.

Our income during this period varied from $3500 per month to $5000.

As one of us was always a stay-at-home parent, our ability to increase earnings was limited, but the important thing is our expenses never varied.

On a bad month, we saved $1000 and on a good month, it could be $2500.

Without fail, the savings account was growing. The only thing that varied was the speed of the growth.

How To Budget Around Your Core Expenses

If you are interested in budgeting around your core expenses instead of letting your income dictate what you spend, here’s how I do it.

1. Work out what you actually need to live each month

Here’s where you’ll need to sit down with a pen and paper and open your bank statements or online banking.

For now, ignore your income.

What you need is a list of your core expenses.

For most, that’s mortgage/rent, insurance, utilities, food, transport costs, debt repayments, memberships, subscriptions, and gifts.

I also recommend setting aside an amount as fun money or blow money or whatever you want to call it.

Restrictive budgets that don’t account for the fun things in life fail (they are similar to diets in that sense).

Look at your bank statements for an accurate picture of where you spend your money.

Add together all those categories into a monthly sum you require to live.

Now you need to look at your income to ensure you’re earning more than you need to spend.

Note: If your monthly figure is more than you earn, you need to go back to the drawing board.

This budget relies heavily on consciously living within your means, so you’ll need to cut costs in order to get your monthly expenses lower than your income amount.

2. Get a month ahead

This is probably the most challenging step but it’s the most important.

The only way my budget continues to work is because I am able to pay for next month’s living costs using money earned this month.

We do not live hand to mouth anymore.

In order to get one month ahead on your budget you need to carefully calculate exactly what you need to spend each month, and then allow an extra buffer.

I figured we’d need $2500 per month in order to pay all of our bills and feed the kids well.

We had that amount in savings but if you don’t have savings, I recommend checking out this post to get you started with your monthly nut.

3. Budget monthly, regardless of pay frequency

On the first day of our monthly budget, I get online and transfer the amount of $2500 from our ‘Savings’ account to our ‘Bills’ account.

I need to have separate bank accounts for this system to work.

I then pay all the essentials – transferring the monthly amount to the mortgage, a monthly grocery allowance to the everyday account, and keeping what’s left over in the Bills account for direct debits.

4. Accumulate funds in a separate account

All the wages and extras – my business income and tax credits – accumulate in the ‘Savings’ account.

I leave them there until we hit our monthly sum of $2500.

Sometimes that will take four pay weeks; sometimes, it takes 3.

We’ve had some cracking bonus weeks’ where we’ve hit our living costs for next month in 2 weeks.

I love those months, but they’re not the norm.

The next step is the same regardless of how long it takes to hit $2500.

I gleefully transfer the excess into our travel savings account.

For now, that is our main focus, so we save towards that each month.

5. Live as if the monthly sum you’ve budgeted is all you have

This is perhaps the most testing step; you must live as if you only have your monthly allowance.

In the beginning, I struggled with this as I knew I had more money in a different account, but now it’s become second nature to only spend the set amounts in each budget category.

Having a large lump sum for my groceries each month is especially helpful, as it allows me to stock up on bulk buys or clearance deals when I see them.

6. Review and amend

At the end of each month, I review our spending to make sure we haven’t overspent.

I also review whether we’ve given ourselves enough to live on comfortably.

6 Reasons It’s Smart To Live on a Fixed Amount

1. You always know what you’ve got available.

The amount never changes.

You will adapt and become an ace at keeping spending in that category within the correct range.

Living frugally becomes second nature.

2. The temptation of lifestyle inflation is eliminated.

All of your salary increases, tax refunds and other extras hit the bank account and have no impact on your spending.

Your spending stays the same whether you earn 50k or 100k.

3. It’s easy to ascertain the amount you’ll need to retire early or travel the world for a year.

4. If you ever need social assistance due to job loss, you are already used to spending small.

You will adapt faster than someone who has been living week to week.

5. You will be filled with that warm fuzzy feeling that you are building wealth. It will help with the challenging times.

6. Any extra money you make on top of your regular income goes directly towards things like debt repayment, building a savings buffer or travel fund.

The extra money might come from an online side hustle like starting an online business or taking online surveys.

So What Does My Fixed Living Cost Life Look Like?

One 23-year-old car

Paid for with cash. It cost $1000.

The front electric windows are stuffed, so we try to avoid driving in the heat of the day in summer.

Other than that, it’s a fabulous car, and we will drive it into the ground.

Cycling to work

When I was the primary earner, I cycled to my office in the central city (an easy 12-minute ride, door-to-door) as often as possible.

It helped us keep our fuel spending under $100 per month.

Shopping around for the best deals.

If that means scouring websites for the best deal, then so be it.

I also run everything I buy online through Rakuten to see if cashback is available before I complete my purchase.

If you’re interested in Rakuten (and you should be – it’s getting back the money you were going to spend anyway), you can join for free.

Use this link to join Rakuten today and you’ll get $10 towards your first eligible purchase of $25 or more.

Haircuts at the local hairdressing academy

A full head of highlights, a cut and blow dry, costs $30.

It takes over 3 hours, but I save over $80 compared to a full salon service, and the quality is the same as all trainees are overseen by a qualified tutor.

That’s an after-tax hourly rate of over $26 for sitting down and reading magazines. Not a bad day’s work.

A starter home.

Currently, an earthquake-damaged starter home. Three bedrooms, big garden.

Close to the central city. Bought with a 90% mortgage in 2011.

Hand-me-down clothes

For my sons and minimal clothing purchases for my husband and I.

A weekly takeaway dinner of fish and chips.

Sometimes Thai or Pizza. But 85% of meals are cooked at home.

A vegetable garden in the backyard

Which produces herbs, lemons, potatoes, lettuce, plums, and courgettes (zucchini).

Plus a weekly $10 subscription (now $12) to our local co-op for two large shopping bags of seasonal fruit and vegetables.

Free activities

Not hard in a city of beautiful parks with a toddler that likes to spend time looking at sticks, rocks and ants.

Kids certainly help you appreciate the simple things in life.

No health insurance.

This is quite common in New Zealand. We currently receive free medical care and prescription medicine for all children under 13.

Sometimes I took my newborn son to the doctor twice per week just to be sure.

General Practitioner visits for adults are around $40 per visit so we pay out-of-pocket.

Prescription medicine is capped at $5 per item for adults.

We probably spent around $150 on medical care for the year.

After travelling the world and seeing what healthcare costs in other countries, I am super-grateful to be a citizen of New Zealand.

Our system is not perfect, but it’s a lot better than most.

Prepaid phones.

We love to travel long-term. Phone contracts are anathema to the mobile lifestyle. Enough said.

The Importance of Having Goals

Living this way has now become the norm.

Being able to travel extensively with my family is worth every sacrifice.

As I put together a plan to chase the summer around the world, my budget will tighten, and I’ll have to find ways to reduce my FLC even further.

Without this huge, crazy dream I’m sure I wouldn’t be motivated to cut costs and keep such a close eye on things.

You need a big hairy goal to keep motivated when things get tough, so work out what that is and get started making it a reality.

I firmly believe we are capable of anything we put our minds to. But we must put our minds to something.

Whether it’s paying off debt, travelling, starting a family or raising a deposit for your first house – there must be a motivating factor.

Frugality for frugality’s sake, would be hard to maintain.

The knowledge that I am living well within my means and the desire to achieve my goals gets me through tough times.

Note: to build a more balanced site about personal finance, I’ve started to explore new budgeting methods.

I still budget the way I talk about in this post, but it might not be suitable for you, and I get that.

Another budgeting strategy that works for many people is the zero-sum budget.

Check out this post to learn more about it: The Ultimate Beginners Guide to Zero-Sum Budgeting.

There’s also the 50/30/20 Budget. Remember, the best budgeting strategy is the one you can stick to!

Related guides:

Damn, girl. Your advice is so good. I’ve been a big saver through my adult life but I never did the budget ‘backward.’ This is fascinating. I’m opening Excel right this second…

Thanks Julie – I love that you are also an Excel nerd! I like to challenge myself to live on as little as possible so the ‘gap’ is bigger. The gap is where the wealth come from.

What a simple and profound shift–I love this Emma–thank you!

Thanks Tiffiney.

I budget the same way, covering my basic costs and everything leftover is going tobdebt repayment or savings goals. Unfortunately we don’t have much left over but we are working on that. We are also used to living on one income while my husband is in school. When he graduates and starts working we plan to continue to live only off my paychecks and shovel his paychecks to pay off our debts. I’m so jealous of your low health care costs, I pay thousands every year in insurance premiums and another few thousand in doctor and prescription copays.

Hi Alice, thanks for reading. Getting used to living one paycheque is a gift that keeps on giving. We’ve done it for years now and it makes the tough times survivable and the good times really profitable! Sounds like you have a lot of good times ahead once your husband is working. And yes, we are very lucky with our healthcare system.

Brilliant way to go about your budget and managing your finances I think! I particularly like your suggestion to resolve to live off one income. Congrats on setting your priorities and goals to allow for the life you want to lead.

Thanks Kurt. I appreciate your kind words. I truly believe living off one income is the single most powerful action couples can take to secure their financial future. That way when/if a child comes along it’s no big deal, you’re already used to living like a one-income family – with a healthy nest egg to boot.

Inspiring!

Thank you.

Thank you Kirsten.

Fantastic blog! I just discovered it from your post in the nz mmm fb page I’m so excited to read all about your road to FI as I share the same goal of chasing summers between my home country of Ireland and NZ with my NZ girlfriend. Keep up the good work, I can’t wait to read more!

Thanks David, I appreciate you commenting. Nice to hear of another NZ/Ireland alliance! We’ll be back in Cork in less than 3 weeks, so looking forward to it. The distance between our 2 countries is such a bitch but also a huge motivator to achieve FI.

ahhh NZ MMM – that is where I have come across you before! Love your advice. I really wish our mortgage was as small as yours! We basically do what you do, but our mortgage payments 2800 a month!! Which is much less than they were before we moved.

Hey Dana! Yeah, we are quite lucky with our mortgage, although living on a homestead in a picturesque valley seems like it’s worth the extra $$!

That’s pretty much what I do. I don’t have a fixed income so I like to know that I have enough money to live on for months to come no matter what.

Yep – it’s a great way to budget if you don’t have a fixed income.

Hi Emma,

I am 21, I live in the states and next year I plan to marry my girlfriend, the love of my life since nine years old. Tonight, I burned both of my credit cards. Combined they have a balance of around $1,200. That may not sound like a lot, but for me, with what I earn each month it is. I plan to pay them off and then close them, but I burned them to shut the spending down. I’ve been living beyond my means for a while now. Not bad, but too much. I just got promoted at work to my very first good full time job. I sat down to budget, all excited about finally being able to afford to start a family and I was heartbroken to find that even though I will now be making good money, it’s simply not enough with my current habits, expensive hobbies and debt. Something has to change.

Your post inspired me that I had made the right decision tonight to burn those cards. It was scary because they are my “safety net”, but I realized tonight that I was lying to myself. They aren’t a safety net and I don’t have them for the reward points. I have them because they enable me to live beyond my means. To be somebody I am not. I don’t have the discipline to say no, so I decided to remove the opportunity to say yes.

Thanks for what you wrote. I’m happy living simply. All I want is a happy little home with my girlfriend and a quiet place to write my novels in the evening after work. The debt doesn’t make me happy. It weighs me down. I want to live within my means. You rock.

From sweet home Alabama,

Ian

Wow – you win comment of the year, Ian 🙂

So glad to read you are getting rid of your credit cards and I absolutely agree – $1200 is a huge amount, especially when you are 21. I often think about how much further ahead I would be now if I had sorted my debt in my early 20s rather than mid 20s. You are so wise to have this revelation now and I have no doubt you have a very bright future ahead of you.

A little place to write in the evenings sounds like paradise.

I wish you and your girl all the best. Thanks for commenting Ian, you have truly made my week!

Great advice. I wish some of our prices and public services were as great as yours in N. Z. Our minimum wage is lower and the prices are higher. One cannot survive on minimum wage here.

Great post! I’m very jealous of your mortgage, that’s how much I spend on rent! Ah, the perils of being single and living in Auckland. However, I have paid off about $3000 of credit card/overdraft debt, and have stopped incurring it this year, so I’m off to a good start, now I just need to work on saving! I’m glad to have come across your blog via brunch club, will be following it now.

Oh for sure – my monthly mortgage now is less than three week’s rent when we were in Sydney. But the trade-off is lower incomes. Big cities = better pay! Well done on the credit card debt, that’s how I started too – and soon became addicted to clearing all my debt. Thanks for reading Lena.

So great to have New Zealander writing about how they are living life and saving money, thank you.

At 37, I’ve given myself the goal of retiring at 57 and travelling. It’s my first year of saving and your tips will definately help!

Keep on writing, I appreciate the inspiration 🙂

Thanks, Liz! That’s a great goal and a realistic timeframe. Lots of people aim to do it in ten years but that requires an incredibly frugal lifestyle and I would prefer to aim for a little longer, as you are, and still enjoy the ride! All the best with it.

Wow. You have solved every question I dint have the answer to when speaking to my darling hubby about budgets. Our situation is unique as he’s a pilot a travels 3-4x month for 4-5 days at a time. New Zealand’s health care amazes me. I’d rather pay $40 out of pocket for a visit than pay $280 month for obamacare and still pay $80 copayment when we go to the doctor. We’ve got a lot of catching up to do. Thank you for this incredible article!! Love from the states??

Great read, interesting and informative, I myself live in New Zealand born and breed and we are very lucky here with our health care and welfare system, being a single mother of four children growing up i was able to look after them and eat and survive quite well, having health problems myself working was not an option for many years, but now im a working mother kids grown up a bit and lucky last at home. I have written up a new budget using your template and I am amazed how much it costs to live with what we earn, seems the cost of living has increased dramatically yet our hourly rate has increased hardly to compensate this, im still a single parent or person rather living on one income paying a mortgage (which im thankful that i have) have no room for a boarder as my art is in there and the room is office size (excuses excuses), but wondering how I can have a buffer, week to week gets unstable and boring and sometimes scary, cheers 🙂 Deborah

Hi Deborah, thanks for your comment. How much do you think a boarder would pay each week? As it might be worth your while to move your art into a portable cabin (Just Cabins etc are around $70p/w to rent) and rent out the room. Or, if you have the time, airbnb the room. You’d get a higher per night rate, but it’s more work to clean the room etc.

I am in the USA and its always fascinating to read about the costs of other countries. But usually where you think you are saving in one category you pay thru the nose in another. Your healthcare sounds wonderful but you did not mention at all your taxes. Homeowners tax, vehicle tax and on and on. How much is a drivers license and getting the license plates for your vehicle? How about food? Food here is relatively cheap (depending of course what state/city you are in) but for instance we have friends in Norway and food is expensive there. Good article.

Hi Loyda, thanks for your comment. The figures mentioned in this article represent our after-tax income as our tax is taken at source (deducted by our employer before net wages are paid). Food is also included in our overall grocery amount. All car expenses are included under car insurance, reg (registration) and wof (warrant of fitness)- that includes annual registration and a road worthiness check. I agree, some food is cheap in the US, but I have found from travels there that fresh fruit and veggies are just as expensive as New Zealand. Packaged food and fast food seems to be cheap. Food in New Zealand is expensive for sure, but we eat pretty well for our budgeted amount.

I absolutely loved your article.i have always budgeted well but when crazy happens, it happened hard for me. I have managed to rack up about $25k in credit card debt, have a big car payment and mortgage. I earn a good salary from my day job plus I do hair on the side for that extra cash. Tell me it’s possible to get debt free cuz I feel like I am pretty smart with money but it sure doesn’t seem that way right about now. I have cut back so much, there is nothing left to cut. I bring in about $4300.00 a month (meaning take home) but have $5500 that needs to go out just on bills. I am saving and have 401k growing so that’s good. Ok my rant is over and thank you for your blog. It was inspiring.

Hi Sheri, thanks for your comment. It’s totally possible to get debt-free, but I can’t really tell you where to make cuts etc without seeing your budget. If you want to email me it’s moneycanbuymehappiness at gmail dot com – and I can let you know my thoughts. $4300 is a good income (depending on where you live, that is). My first thoughts would be the car (I drive a beater from 1992 to stay debt-free) – could you sell it and make back enough to pay back the loan on it?

Emma, I’m boggled at the thought you spend less than $100 per week on groceries and eating out. How ? Admittedly I am feeding 4 adults these days, one body building so heaps of protein and two gf which is expensive, but there is no way I could I could get anywhere close to that. Assuming groceries also includes cleaning products, toiletries, loo paper etc ? Would love to see a months receipts to see where I’m going wrong. Fascinating article though, and enjoying your blog.

Thanks, Cathie! Unfortunately, my food budget is a lot more than that now. But at the time of writing this article in 2014/15, we managed to feed 2 adults and one baby (breastfed) on that amount quite easily. I’m nearer to $175/week now with 2 kids and 2 adults. We do eat a lot of lentils though 🙂 and yes groceries include everything, although I use white vinegar for cleaning so that’s cheap. Shampoo, conditioner etc is Tre Semme for the whole family, loo paper is whatever is on special and nappies are always store brand. Eating out has almost completely disappeared from our budget unless there is an amazing deal or it’s a special occasion.

This came up in my Pinterest feed! Very smart and true. Thank you for the inspiration ?

Thanks Kim 🙂

Great advice, thank you! I have found myself divorced at 45 and a single mom to two teenage boys. I bought my home a few years ago but after living by the skin of my teeth for four years and watching my debt slowly creep up, I have decided the best option for me right now is to bite the bullet and move home with my parents, who have a very large separate living area where the boys and I can live very comfortably and privately. One of the best parts about this plan is it will also allow my parents to stay in their home instead of downsizing, as they had been planning, due to their reduced retirement income. Once my house sells, I have planned on wiping the debt out quickly by putting what I would have been paying on mortgage onto my credit cards and car, and then using what I would have paid in household expenses such as utilities, etc. to my parents for rent. Although I have been using credit, I have also been putting a modest amount in two different savings accounts each month, so I will continue that until my debt is paid off, then I can really start to pile money into savings. I think the FLC plan can really be a great benefit to me and I hope to come out of this in a few years in much better financial position to own a home again. Can’t wait to get started in the coming months! Thanks again!

Thank you for sharing your experience, Jean. It sounds like you’ve worked out a solid (and creative) plan to get back on track and also help your parents at the same time. I have no doubt you’ll be in a better position in a few years time simply because of your attitude. People who can figure out non-conventional means of solving problems usually always end up OK, I’ve found. All the best with it 🙂

What an awesome post! Im so happy to be hearing from a kiwi. Your expenses/income are similar to mine so I can totally see how I can change my situation “in real life”, (if you know what I mean) here in good old NZ.. Thank you.

Kirston.

Thanks Kirston! All the best.

This was a good read! That scenario is too familiar. There are so many ways to trim back and still live well. It might mean changing interests and hobbies though.

Thanks for a good read. I also budget backwards and find it works well. I live in NZ too great to find a writer from home. Do the rebates work for NZ as well? I always thought it was for America. We are building a home so this could save us some $$. Thanks ?

Hi Helena – do you mean Ebates? If so, yes I use it all the time. Mainly for BookDepository and travel bookings. It pays via Paypal in USD, but that’s quite simple to transfer to your AU/NZ bank account. Join with this link if you’re interested.

I absolutely love your post! I definitely agree with getting a month ahead for bills. It’s a safety net and gives you security if an emergency happens. My mortgage is always a month ahead and any extra money all goes to the principle to pay it off early. And having a motivating factor is so important. Always having goals will get people to strive for more out of life. This is a great read!

So what is the name of the book,you talk about?

Hi Pat, it’s called ‘The Simple Path to Wealth: Your road map to financial independence and a rich, free life’ and you can find it on Amazon here:

So helpful thank you! We are trying to save money for a house now and planning ahead before wa have babies! I’ll note all of this down and begin to save!

Omg 40.00 for car insurance?? We pay almost 600 a month in Louisiana! Our homeowners insurance is high as well. It’s crazy but that is what it costs here. I try hard to cut in other areas though and have started building our savings. Thanks for your tips!

Wow – that’s nuts. Our car is not even worth what you’d pay in a year for insurance. We have just renewed our insurance and it was $300 for the year. Home insurance is higher due to our earthquake risk – it’s now over $100/month.

Good on you for growing your savings!

Thank you for your post. It was thought-provoking. We live in Australia and enjoy the benefits of social medicine too. It is nice to know that no matter the medical situation we will be looked after. We live in a remote location and find that food and fuel for the car are very expensive, but our wages are higher too. Our biggest extra expense is Private School fees, but given our location and limited options, we feel that this expense is not negotiable. I am going to work on looking at my budget backwards and see if I can find some more ways to save. We have eliminated all debt aside from our mortgage, but I dream of living mortgage free!

Hi from UK. I budget but think I’ll swap to your method as I’ve been medically retired due to terminal illness so on benefits, and I’m too young to draw a pension, everything gets paid into interest earning account and as bills get paid money’s transferred, just enough to be in black so no charges, but fur-baby on medication now not claimable on her insurance, so one more added outgoing, so something will have to go in order to finance that. Wish me luck in working on this

Interesting way to think of budgeting as so many would take income first and then spread it among the expenses. I am going to have to try this method personally as it actually looks easier as well. I am a true believer as well in the pay yourself first otherwise you are right all other expenses will eat up any remainder of the money.

I need to move my fam to NZ! We live in the states. One of the most expensive states too. We just moved our family from the area we grew up in our entire lives, to move to a “cheap” area where we know no one and still pay over your entire monthly budget, just for our mortgage! We eat out (cheap pizza) 1-2 times per MONTH, don’t buy toys, clothes or any other “luxuries” unless it’s a holiday. We rent movies once per week as our entertainment, for $2.00, and have no car payment. All of our money goes toward mortgage, insurance and medical costs and past debt that came about due to emergency situations. I grow a garden of veggies and herbs every year to help with food, but our weather only allows for that 2-3 months of the year. I buy in bulk as much as possible and cook meals at home. We don’t waste ANY food and eat every left over possible. I’ve been forced to reduce our food budget to $75-$100 per week for a family of 4. I’ve been forced to go to the Food Bank just to get necessities (milk, rice, noodles) for the week. I worry constantly about the health of my family because of how I’m forced to feed them now. Mostly cheap, boxed, frozen food that’s packed full of chemicals and made in a lab. I spend most of our food budget on fresh produce for my kids to keep them as healthy as possible. We have a 2 income family, we don’t spend on “extra’s” or travel or do anything that costs money. If we go to a store, it’s just to walk around and look, not to actually buy anything. We’ve gotten very good at entertaining our kids for free and they find joy in our simple pleasures, but they are getting old enough to realize that they don’t get to join in activities with friends that cost money and they’ve started to ask why and make comments about us being “poor”. I tell them we are not poor, just smart with our money. But I know they see it in my eyes, they see me dry the tears every time I pay bills, they hear my panic and pleas when I’m on the phone trying to beg for financial assistance for medical costs. We are always told that we make too much money to qualify for any support or help, but yet, we can’t afford to pay our basic housing expenses. Our country is the land of dreams and opportunity, but it’s also built on the rich becoming richer and making their kids rich, providing opportunities that middle class families and children don’t have access too. Something is broken here and our children are suffering because of it.