Last month I wrote about how we live on a fixed budget. In that post, I mentioned that we lived in a starter home. I really should punch myself in the face for typing those words into my own blog because I hate the term ‘starter home’.

Let me tell you why

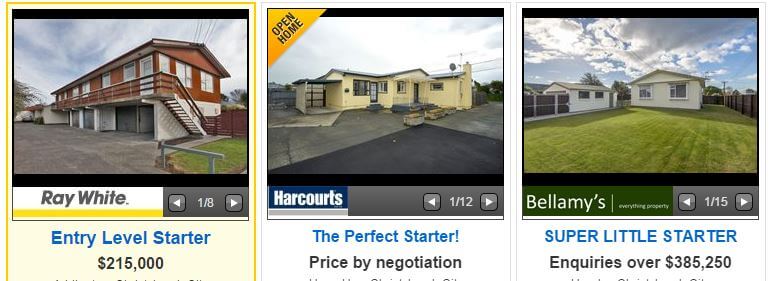

I’m pretty sure the term ‘Starter Home’ was coined by the real estate industry who wanted to ensure you know your place on the property ‘ladder’. In case you don’t, it’s at the bottom. You live in a starter home. That’s the first rung. Just above the dirt.

The Kiwi/Australian/American/British/Irish dream (I can honestly say that after travelling to all of these countries that we are all fed the same bullshit dream) tells us that we should buy our first house, renovate it and then in a few years sell and use the equity gain to trade up.

To a middle-class McMansion. With a McMansion mortgage to match (oh – the alliteration).

This ‘dream’ assumes you are going to work in your career until you make it to the top. Paying off your mortgage over 30 years is manageable with your healthy salary. Hopefully, you won’t die of a heart attack at 48.

So Emma, what’s wrong with this attractive sounding dream?

Nothing. If it’s truly your dream. Not one you were fed by some real estate agent or family member. If it’s not your dream to continue upping your mortgage payments until you die, keep reading.

What exactly is a starter house/home?

Starter homes are typically in lower socioeconomic areas and therefore come with a lower price tag. In New Zealand, they are likely to be older homes needing renovation work.

They are almost always livable from the outset but you probably won’t be hosting dinner parties for a while.

Talking only about the real estate markets in which I am familiar, starter homes tend to be either ex-rental properties or someone else’s first home. They may be in areas where a large percentage of people rent.

Our starter house is 120sqm (1290sqft) consisting of three bedrooms, one bathroom, and two toilets. It is painted the vilest peach colour I have ever seen.

It is less than 4km to the city centre and within walking distance of two schools. We paid $225,000 in 2011. It’s currently worth around $325,000 (or it will be after earthquake repairs are completed).

Before we purchased the house was used as a rental for ten years and prior to that, it was a family home.

Here’s what’s wrong with the McMansion dream.

A house is not an investment (unless you are purchasing rental property), it does not produce income. Pouring all your money into it is just stupid.

The smart thing to do is take care of your housing expense as early as possible by finding the cheapest way to live that you can tolerate – and buying a starter house is the simplest way to do this.

Then you can use your employment income to build a portfolio of income-generating assets like stocks (shares), bonds, term deposits, rental property, whatever you like.

(If all that sounds like gibberish to you, I suggest reading The Simple Path to Wealth: Your road map to financial independence and a rich, free life – it’s my fave personal finance book for newbies. More ideas here)

Why is a starter home a great place to build wealth?

- Starter homes are usually in low to mid socioeconomic areas and come with a lower price tag to match.

- The mortgage payments are affordable. Lower loan balances mean lower repayments. If you decide you don’t want to go back to work right after having kids, the mortgage on your starter house is manageable on a lower-income. Also excellent if a frugal life is your goal.

- You don’t have to keep up with the Joneses. Everyone else will be mowing their own lawns, doing their own repairs and DIY jobs.

- Usually in high rental areas. This means if you want to take a year off and travel, it’s likely there will be a big market of potential tenants.

- Resale. If you need to sell you’ll likely have a bigger pool of buyers – both investors and first home buyers. Since you bought a starter home the price appeals to a larger group.

- You can pay it off faster, freeing up money to build real wealth with income-producing investments.

- You can alter it to suit your requirements when you have the cash.

- Staying in the one house eliminates all the costs that go with buying and selling. In New Zealand that means legal costs, bank financing costs, engineers and surveyors reports, real estate agent commissions, the cost of staging your property for sale – this list goes on.

- If you buy in an area with good prospects and stick around for life, you’ll likely see gentrification happening and make a nice capital gain on your property value if you decide to downsize when you are older. Even if the value of your property only keeps pace with inflation you’ll still do well over the long-term. Meaning if you, like me, want to retire in Mexico you’ll have a nice stash of cash to take with you.

- No weird covenants – like this housing estate/subdivision in New Zealand that dictates what kind of letterbox you have.

Buying an affordable house and paying down the mortgage before you reach retirement age should be the minimum financial investment you make.

At the very least you’ll have a stable home for your retirement years, even if you are relying on Social Security/NZ Super for living costs. And you won’t have to deal with roommates in your old age like in this funny but terrifying Kiwi ad.

Renting for life is risky, anyone planning to rent for life better have a smart investment strategy behind them. Look at NZ Super (our equivalent of social security/pension) – it’s enough to live on, currently at $576.20 weekly for a couple – but that’s assuming you have a mortgage-free home.

With the median rent in parts of Christchurch at $410 per week renting in your old age would not only suck, it’d probably kill you.

My starter house is part of my retirement plan. I intend to clear the mortgage within a decade (update: done) and then funnel those mortgage payments straight into retirement funds.

No doubt, I’ll be renovating and making alterations to the house as I go, but I’m betting that compared to closing costs and upping mortgage payments on a new property, I’m going to end up much better off.

What do you think? Would you live in a starter house forever?

Ugh, this totally takes me back to the one and only home I’ve owned. We bought a ‘starter’ home in Maine (USA) literally JUST before the economic collapse. Like mere moments. Fortunately we had purchased a home well within our means so when it went down like 20% in value, we didn’t get killed when we eventually sold for less than we bought. Goes to show that buying is NEVER a guarantee money maker, right? (congrats on the crazy traffic btw…amazing!)

Ouch, that must have hurt. But you guys were smart and purchased within your means so as you say it didn’t kill you. Needing to sell in a downmarket is not a situation I’d want to be in.

I agree completely with what you are saying having owned 5 houses over 25 years, from a tiny starter to McMansion which I lost the most on. I wish I had kept my first starter house in cold spring harbor Long Island. It was only 1100 SF so no clutter, and at least tripled over that time. Would have been the best rental as well. Investing in houses overseas also has the big risk of currency devaluation. I opened and account in NZD in 2009 and converted at .65c it went up to .88 and is back around .70. That is around a 25% drop from the peak. What caught my eye was your mentioning Mexico as a retirement location. Where would you go as I am in the process of looking into Mexico

Hi Andrew – you are so right about the currency risk. I’m not sure I could invest in property overseas. The NZD has dropped around 8 euro cents since we did our last transfer, so I’m relieved we should be able to make the Euros we have stretch until we get home.

As for Mexico, we’d love to move to Merida in the Yucatan but the heat in summer is overwhelming so we might look at somewhere up in the mountains.

I like your thinking. We are in our second house, but still what you would call a “starter home”. However we have no intention of trading up any time soon, for all the reasons that you mentioned. We love that we aren’t over committed as this gives us a lot of lifestyle flexibility. The biggest challenge we find is staying disciplined to pay down the mortgage as soon as possible. Setting and regularly reviewing short, medium and long term goals really helps.

Nice one, Amy. As you say the lifestyle flexibility of a smaller mortgage is wonderful. And with interest rates falling hopefully we’ll be able to pay down the mortgage a little faster.

Our “starter” house is a little 60sqm 2-bed place. But its 6km from the CBD in Wellington, 15 minutes by bus, 10 minutes by train. We have two good schools, a library, several parks and reserves, and a local shopping area within close walk. The neighbourhood is good.

We would love more room, but a third bedroom would double our house “price” (and more than double our mortgage) if we stayed in the area. If we moved further out, we could get more house for the same money, but, more travel time and cost etc etc.

So we are thinking of staying. Long-term. There are only three of us (will only ever be three of us), and we have a lawn, vege patch, 2-car off street parking, nice neighbours, two bus routes almost on our doorstep etc etc. More importantly, we should be mortgage free within 15 years of ownership, despite me spending 5 years out of the workforce.

Yes! Sounds like you are in the perfect place Amelia. And although 60sqm might seem small to Kiwis it’s pretty spacious compared to how people live in big cities around the world. Plus the outdoor space makes such a difference.

Doubling your mortgage and extending your commute sounds quite awful, I’m voting for you to stay put too – although it sounds like you’ve already made the smart decision.

I’ve only owned one house which I gave up in a divorce. It worked out well. But as I’m approaching my 50 year birthday, I’m looking at where I’m going to retire and I’m tired of living in an apartment. So a “starter home” it is/will be for me.

I think you are right about the “starter home” terminology

woops, I hit the button too fast.

I’ve started looking at shipping container homes as a possible way to have a home that can withstand weather and be reasonably affordable.

You shouldn’t buy a house just to renovate it, you will use a lot of money, and get so little out of it. Buy a house, and renovate to improve what you want, if anything. Waiting to renovate is a great idea. Wait until you actually start not liking something about the house.

I’ve just bought my third and final house. My first house I bought solo in my mid-30s – walking distance to town. I sold it because I was starting life with a partner and we wanted “our” space – but so glad I did – it was leaky (I sold about a year before the proverbial hit the fan). The house we bought together was big because we had difficult blended family (dog+cat). We rented that out when we travelled and decided if we could sruvive 6 months in a tent together we didn’t need 200m2 in Wellington.

Our next house was a sensible 3 bed townhouse in Johnsonville – I work from home so I need the 3rd bedroom. Must admit we had no intention of moving – but fell in love with our current home by the sea in Titahi Bay – had no intention of moving again or renovation again. But this is our last house we’ll never move – though I may well house swap in the winters!

Will a realtor be there to help you out with finalizing work on one of them starter homes? Looking at these homes reminded me about what my wife has been telling me about so much. She’s always be bringing up the idea of buying a small house to live in while we improve our economic condition.

We already own the property. We organised the purchase via the sales agent, not a buyers agent. That is the norm in New Zealand.

I love the idea of a starter home. It would be nice not needing to worry about too much upkeep or having to pay huge mortgages while you are just getting your feet wet when it comes to owning your own home. Thanks for the advice!

Thanks Drew.

Buying a starter home really is a smart decision. It doesn’t have to be big and flashy, like you said, the one we bought was dirt cheap. It was furnished, but the quality definitely wasn’t that great. However, it worked, and now we have a nicer house.

I am planning on getting married this summer. I would like to stay in a starter home. I just don’t know if that would be the best option. I like how you talk about the mortgage payments. Honestly, I was most worried about those. It reassures me to know that they’re affordable. Thanks for the help!

hii,

Buying a starter house has always been beneficial for me. I am into the business of real estate from along time. Purchasing a starter home, then renovating it smartly and selling it a good price has always helped me to make a good deal.

Nice post buddy.

Cheers,,!!

I agree that buying and staying in one home is financially beneficial. Granted, it can be monotonous to live in the same place for years and years. However, once you buy your home, you can easily decorate it the way you want to to make it feel more like home. Plus, like you said, you can rent out your house to visitors if you decide to go on an extended vacation. Thanks for the article!

The price is just one thing to ponder when buying a first home. Thank you for sharing ideas when buying a starter house.

I cannot agree more with Hazel and most of the comments. I have lived in my starter home for twelve years and it has been great so far. Just added a fence on top of the rock wall area which rock walls are common here in El Paso 2 years ago in 2014. Texas and an extra gate. I got rid of the swamp cooler last year of 2015 and added in refrigerated air. I also had a large shed built out back to get rid of the clutter in the garage. I also had the outside painted 2 years ago in 2014. I am in the process of having the inside of the house painted as well. Later on landscaping to my taste. So, you are right Hazel and others that you can do what you want to a starter home and make home for years. Also the city is building out towards were I am living. They just built a park in the back of our housing area and it is nice. There is a large regional park across the street and a nice housing area Red Stone next to it. They are building shopping center across the street from Red Stone and across the street from where I live. They have just built a nice strip mall across the highway from where I live with a WalMart neighborhood market attached. So, the city is moving out towards us here. Oh I had to add a new garage door opener to my garage. I love it. Reasonable mortgage payments a place to call home and a nice area live here in North East El Paso Texas. Beautiful view of the Franklin Mountains as well and Trans mountain highway which runs through the Franklin Mountain range. Nice for hiking. Buying a starter home is a good idea financially for me and others.

This is such a great post! My husband and I just bought our “starter” house, and we intend to stay in it for a very long time. The best part about buying a cheaper house at the low end of the market is that we actually have hope to pay it off before we are 40!

Yay for early mortgage payoff!

I completely agree with your entire fabulous article. We are fed this housing ladder nonsense from birth and rarely question it. I only started questioning it myself when I started reading about minimalism and early retirement in mid 2015 (lightbulb moments!). I recently read an article on interest.co.nz saying you can move up the property ladder everywhere except for Auckland (mostly) and Queenstown (where I live). The article just presumed we all need to upgrade to the McMansion etc. Even my in-laws question us staying in our so-called starter home. We can’t afford to ‘upgrade’ without moving towns now anyway, and it would have been extremely painful even before the housing crisis. 120m2 with 2 wee ones suits us too, especially after I decluttered. Thanks for challenging the paradigm 🙂

Thanks, Vesper. I love that you had those lightbulb moments! They are such a gift, because once you start questioning things like the housing ladder, other ‘norms’ follow. Really, a great life can be had for very little outlay, if one is prepared to think differently. It’s wonderful. Welcome to the club!

I love that you are striving to become a location independent entrepreneur and still believe in owning a property. So great to have a home as an investment while you chase the sun! That’s inspirational. Thanks for sharing, Emma!

I enjoyed this article. All of your points were spot-on. Starter homes are almost always a great investment.

You make some really great points! Paying off a house more quickly and thus being able to direct funds to savings goals is an especially smart move. I will have to consider all this whenever I buy my first home. Thanks for sharing!

This article is not only helpful for the new home buyers but also I totally agree with the idea! Very well explained!!

Sounds great! Don’t think we have them in the UK but it’s a nice idea.

Hi Emma. I have just come across you page It is fantastic reading. I have a budget plan very similiar to yours. I would love to own my own home. Thank god I pay cheap rent. I live in Invercargill. So the Sterio Type of Invercargill also makes for cheaper houses in Nz more so if you live in South Invercargill. The Nz Governmenment brought in kiwisaver over 10 years ago which be used to buy your first/starter home. Plus there are also other benefits you could be entitled to as well. But depending on the bank you are with you need a 20% deposit or one bank offers a 10% deposit. Being a seasonal worker e.g Freezing Worker you soon learn how to live frugally in the off season. My dream is to own a house that has a heat pump and a heater in the bathroom. ☺

Awesome points made! We’ve passed this on to our family and friends for a good read!